Troubled Launch of the Fisker Ocean SUV Leads to Financial Woes

Fisker, a leading electric vehicle (EV) startup, is facing a severe cash crunch and has announced plans to reduce its workforce by laying off more employees. The company’s struggles come just two months after it cut 15% of its staff, highlighting the challenges facing the EV industry as a whole.

Fisker’s Cash Crisis

According to a recent U.S. Securities and Exchange Commission (SEC) regulatory filing, Fisker has just $54 million in cash and equivalents as of April 16. This amount is supplemented by another $11.2 million that cannot be immediately accessed. The company has stated its intention to raise money to pay off a loan it defaulted on in order to avoid bankruptcy.

Outstanding Loan Balance

As of mid-January, Fisker’s outstanding balance for this loan was north of $300 million. This significant debt burden is putting immense pressure on the company’s finances and contributing to its current cash crisis.

Reducing Workforce and Physical Footprint

In an effort to conserve resources and reduce costs, Fisker plans to "reduce its physical footprint." This move will likely involve downsizing or closing some of its facilities. The company still employs 1,135 people globally as of April 19, down from 1,560 at the end of 2022 and around 1,300 at the end of September 2023.

Fisker’s Struggles Continue

The Fisker Ocean SUV, launched in June 2023, has been plagued by numerous issues, including buggy software, reports of sudden power loss and brake failure, and insufficient customer service. As a result, Fisker struggled to meet internal sales goals and lost track of millions of dollars in customer payments for some of the vehicles it did sell.

Internal Audit and Price Cuts

An internal audit helped recover a majority of the missing funds, but not before the company had already slashed prices on its existing inventory by as much as 39% in an attempt to generate short-term cash. This drastic measure is a testament to Fisker’s desperate bid for survival.

Investigations and Delisting

The National Highway Traffic Safety Administration (NHTSA) has initiated three separate federal investigations into the Ocean SUV, citing concerns over safety. Although Fisker has not issued any recalls, it has paused production of the vehicle while the company works to address these issues. Furthermore, the company’s stock was delisted from the New York Stock Exchange due to its poor financial performance.

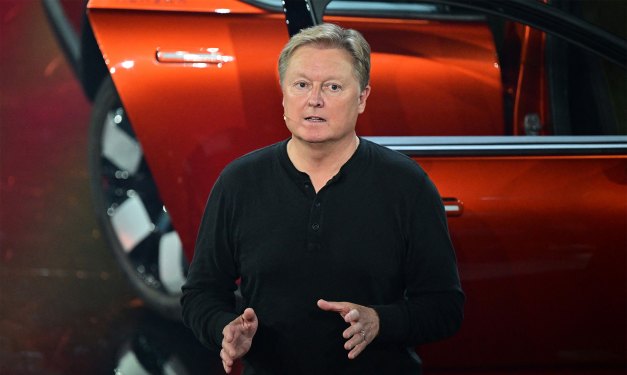

Henrik Fisker’s Second Automotive Startup in Trouble

Fisker’s current predicament is a stark reminder of founder Henrik Fisker’s previous venture, Fisker Automotive, which filed for Chapter 11 bankruptcy protection in 2013. If Fisker ultimately seeks bankruptcy protection, it would mark the second time one of Henrik Fisker’s automotive startups has faced financial difficulties.

Timeline of Events

- June 2023: Fisker launches its first electric vehicle, the Ocean SUV.

- February 2024: TechCrunch reports on the numerous issues plaguing the Ocean SUV, including buggy software and customer service concerns.

- March 2024: Fisker announces it has cut 15% of its workforce as part of a restructuring effort.

- April 16, 2024: Fisker files an SEC regulatory filing revealing its cash crisis and efforts to raise money to pay off debt.

- Present day: Fisker continues to struggle financially, with plans to reduce its physical footprint and lay off more employees.

Conclusion

Fisker’s situation serves as a cautionary tale for startups in the EV industry. Despite its best efforts, the company is facing significant financial challenges due to a troubled product launch, cash crunch, and regulatory issues. As Fisker navigates this difficult period, it remains to be seen whether the company can recover and emerge stronger on the other side.

Related Topics

- Electric Vehicle Industry Challenges

- Startups in Crisis

- Financial Management for Small Businesses